All wait lists are now closed. If you are already on the wait list, you can check your status online.

If you are experiencing a housing crisis or homelessness, call Coordinated Housing Access at 503-655-8575.

The Section 8 Housing Choice Voucher program is the most well-known and sought after housing program in America. There are more than 2,400 housing authorities in the United States, including the Housing Authority of Clackamas County. We are funded and overseen by the U. S. Department of Housing and Urban Development (HUD).

Program participants pay 30% of the household’s monthly income towards rent, and the rest is paid to the landlord by the housing authority that manages the household’s voucher. The program allows voucher holders to rent a unit of their choice that accepts vouchers and meets the program’s guidelines – we make sure they’re in good condition and charging reasonable rent.

This program can be confused with the Section 8 Project-Based Voucher program, where people are required to live in a specific housing community.

Due to high demand of both these programs, there is always a long list of people who want to take part. The demand is so high, we are only able to open our waiting lists or short time periods throughout the year.

Translate

Translate

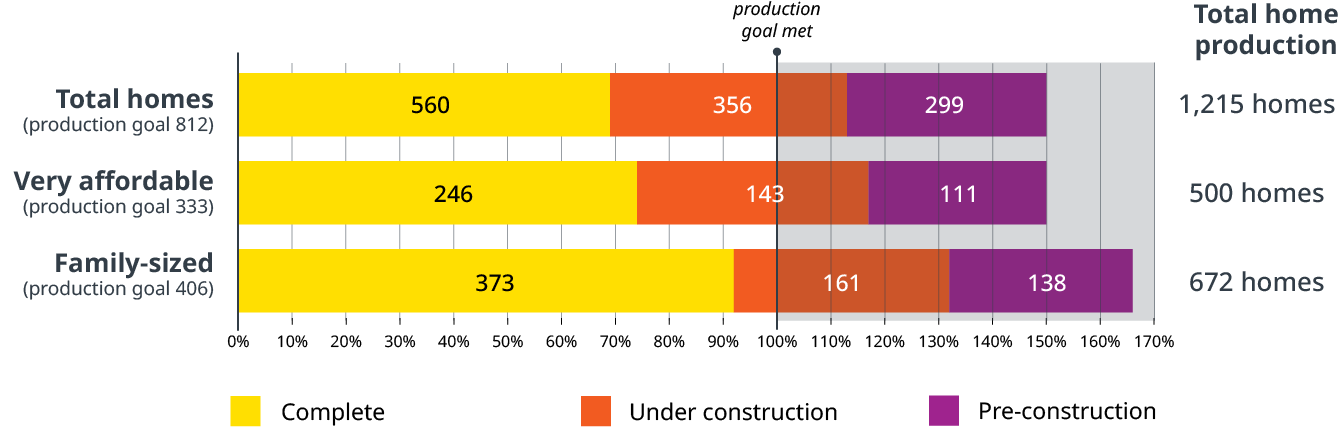

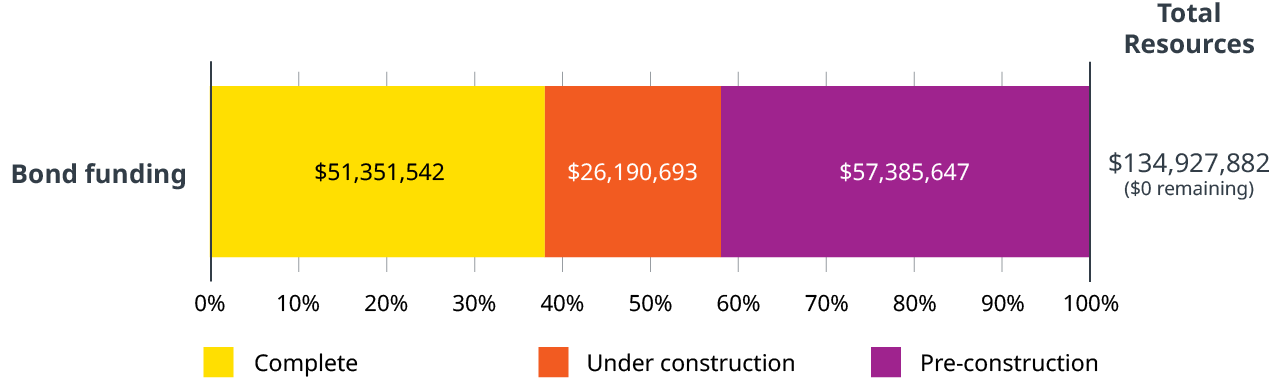

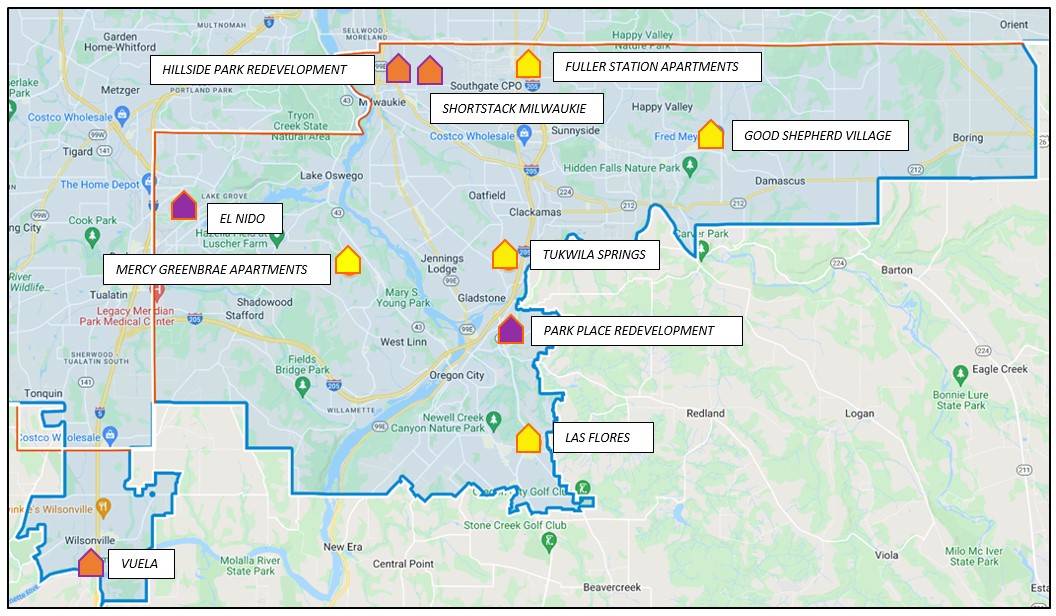

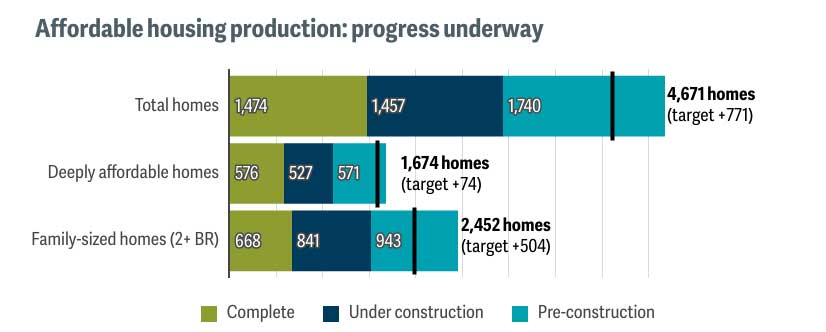

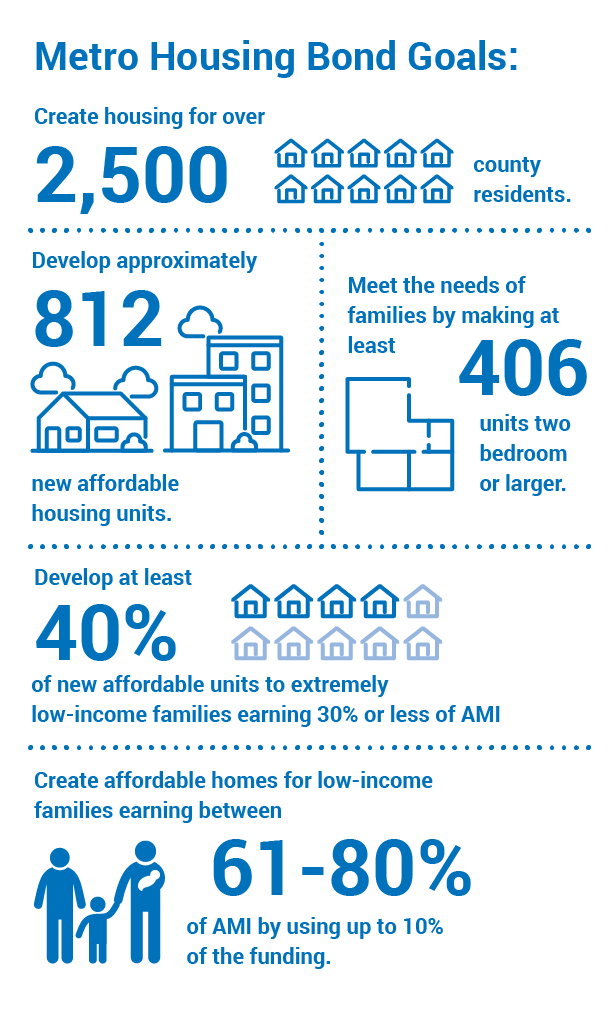

These funds allow the county to shape the landscape of housing that will serve our communities affordable housing needs for decades to come. The county’s goals for the bond funds are to:

These funds allow the county to shape the landscape of housing that will serve our communities affordable housing needs for decades to come. The county’s goals for the bond funds are to: