How voter choices may impact your taxes

Approximately 3,330 property owners in Clackamas County will see higher percentage increases to their property taxes compared to the majority of the county because of two voter approved bonds affecting two districts that overlap within Molalla.

| District | Rate | Contact |

|---|---|---|

| New Bonds | Actual | |

| City of Molalla | $0.8489/$1,000 | Cindy Chauran 503-829-6855 cchauran@cityofmolalla.com |

| Molalla River School District | $1.5411/$1,000 | Andy Campbell 503-829-2359 andy.campbell@molallariv.k12.or.us |

Questions?

If you have questions about one or both voter approved bonds, please contact the appropriate contact listed above responsible for communications concerning each bond.

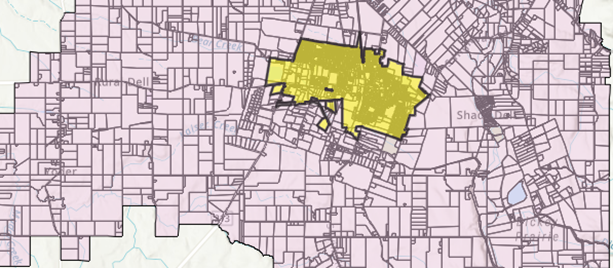

If you live in Molalla and you would like to see if your property is within either taxing district, enter your address to highlight the location of your property using the below interactive tax lot map.

Look up statements using online tool

This year’s statements will be accessible on our website at the end of October. To help you see and compare your current property taxes to last year’s property taxes online, go to https://apps.clackamas.us/taxstatements/

Find additional information about the two bonds

https://protectmolalla.com/

https://current.cityofmolalla.com/new-police-department-and-police-bond-updates?tool=news_feed

https://www.molallariverschoolbond.org/o/bond/page/about

https://www.molallariverschoolbond.org/

Learn more about Clackamas County property taxes

Attend a virtual Property Tax Town Hall on Nov. 6 from 6-8 p.m. or contact the Assessor’s Office at 503-655-8671 or propertytaxinfo@clackamas.us

Translate

Translate