If you're a Clackamas County resident or property owner, you have the option to buy flood insurance whether or not you live in a floodplain. Contact an insurance company to purchase flood insurance. You may also contact the Planning Division at 503-742-4500 for additional information about County floodplain regulations and their relationship to FEMA’s National Flood Insurance Program (NFIP).

If you're a Clackamas County resident or property owner, you have the option to buy flood insurance whether or not you live in a floodplain. Contact an insurance company to purchase flood insurance. You may also contact the Planning Division at 503-742-4500 for additional information about County floodplain regulations and their relationship to FEMA’s National Flood Insurance Program (NFIP).

Here's why . . .

- Homeowner and business insurance do not cover flood damage. Separate flood insurance must be purchased to cover flood damage and loss.

- Just a few inches of flood water can cause tens of thousands of dollars in damage not covered by homeowners insurance. Over the past 10 years, the average flood claim has been nearly $48,000.

- You're not just at risk of a flood if you live near a river; floods can also occur because of clogged drains, surface water back-ups and flash floods.

- You don't have to be in a floodplain to buy flood insurance. Because Clackamas County is in the National Flood Insurance Program, all residents and business owners in unincorporated areas are eligible to buy flood insurance.

- Flood insurance is the most economical protection from devastating financial loss from a flood. During the Sandy River flood in Jan. 2011, three houses were damaged beyond repair and one house was swept downstream. Three of those homeowners had up-to-date flood insurance coverage, including one outside of the mapped flood zone. The flood insurance covered most of their losses. The owner without flood insurance was left on their own to recover from the devastating loss.

Prepare for possible future floods

- Buy flood insurance if you're in any floodplain, and consider it even if you're not, especially if you're near the Sandy River.

- List all your personal property, including furnishings, clothing and valuables. Take pictures or video of your home and contents, especially high-value items; keep insurance policies, pictures, videos and lists of personal property in a safe place.

- Put together a 72-hour disaster supply kit. For details, go to the American Red Cross or Ready.gov.

- Consider ways to reduce long-term flooding risk, such as elevating your home or moving it to higher ground, building floodwalls or berms, flood-proofing and protecting utilities.

- Plan how you would evacuate in the threat of a flood, such as what to take with you, the safest evacuation route and where to go.

Help prevent floods

Don't dump or throw anything into ditches or streams

A plugged channel cannot carry water, and when it rains, the excess water must go somewhere.

Remove debris, trash, loose branches and vegetation

Keep banks clear of brush and debris to help maintain an unobstructed flow of water in stream channels. Do not, however, remove vegetation actively growing on a stream bank, which is regulated by local, state and federal agencies.

Obtain a floodplain development permit and/or building permit, if required

To minimize damage to structures during floods, the county requires all new construction in the floodplain to be anchored against movement by floodwaters, resistant to flood forces, constructed with flood-resistant materials and flood-proofed or elevated so the first floor of living space, as well as all mechanical and services, is at least one foot above the elevation of the 100-year flood. These standards apply to new structures and to substantial improvements of existing structures. Most other types of development within the floodplain also require a floodplain development permit, such as grading, cut and fill, and bank stabilization techniques.

Flood Insurance rates rising to cover costs; County residents still eligible for discount

Flood insurance rates are increasing. The NFIP, founded in 1968, provided subsidized insurance rates to people with homes that did not meet minimum standards but were built before FEMA's new flood mapping existed. Now, after years of massive storms such as Hurricanes Katrina and Sandy, NFIP is out of money and deeply in debt. In order to help the program become solvent and build a reserve fund, federal legislation approved in 2012 requires that flood insurance rates reflect the flood risk of the property.

While some people with flood insurance will not see an increase because their rates already reflect their flood risk, others will need to pay significantly more based on their actual flood risk. Some rate changes have taken place, and others become effective October 1, 2013. Triggers for rate changes include policy lapses, map changes and property purchases.

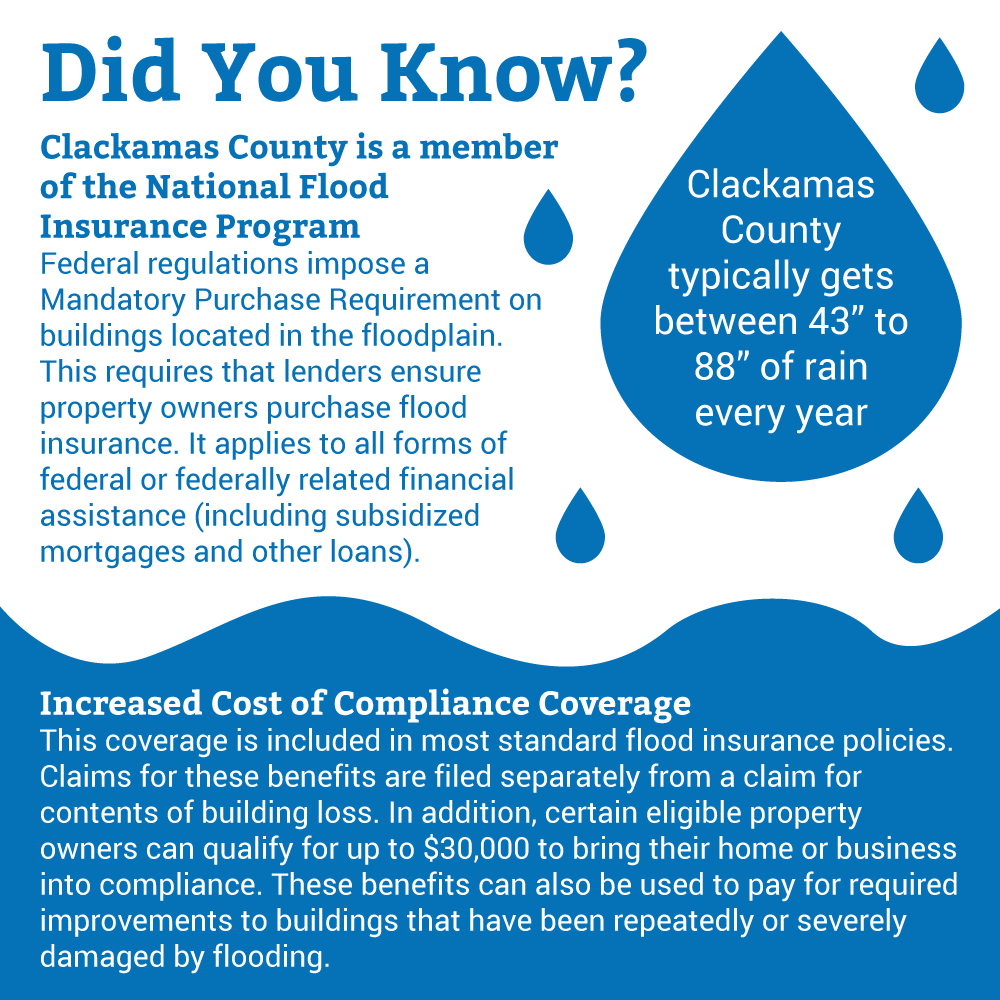

As a NFIP member, the County must oversee floodplains based on Federal Emergency Management Agency (FEMA) standards. In turn, property owners must buy flood insurance for residences in the floodplain. By law, lending institutions require flood insurance for structures in a floodplain and have the option to require it for other areas.

For more information

- Clackamas County floodplain information

- Clackamas County Disaster Management Flood Hazards

- National Flood Insurance Program, Federal Emergency Management Agency

202-646-2500 - Clackamas County Planning & Zoning

503-742-4500

Translate

Translate