Welcome to #ClackCo’s budget page. We are transparent with the spending of taxpayer money.

Our work helps fulfill the goals of Performance Clackamas, our overarching strategic plan.

You can access #ClackCo’s budget through a service called OpenGov. See exactly how your county is spending public funds — and get as detailed as you’d like.

Explore Our Budget

Follow the Money

Where does the money come from?

- Federal, State, Local, All Other Gifts & Donations (37%) are comprised of grants and non-property taxes (capital grants, cigarette tax, Forest Products Reserve).

- Charges, Fees, Licenses, Permits, Fines, Assessments (26%) are payments for services the county provides (building permits, dog licenses, marriage licenses, campground fees).

- Taxes (23%) are mostly comprised of property taxes.

- All Other Revenue Resources (14%) includes the Transient Room Tax, asset sale proceeds, and franchise fees.

Where is the money spent?

This graph shows expenditures per the county’s five overarching strategic priorities, per Performance Clackamas.

- Healthy, Safe & Secure Communities (58%)

- Accountable Government (17%)

- Strong Infrastructure (15%)

- Vibrant Economy (8%)

- Natural Resources (2%)

How is the money spent?

- Personnel Services (29%) includes staffing costs (wages/salaries/benefits).

- Materials & Services (25%) are costs attributed to maintenance, repair, operations, rents/leases and supplies.

- Capital Outlay (7%) includes capital purchases (vehicles) and capital projects (bridge construction).

- All Other (52%) includes debt to finance capital construction/capital acquisitions/cash flow, and special payments to other organizations.

Property Taxes and the General Fund

Did you know that Clackamas County only receives about 18% of the property taxes raised in the county for general operations? More than 80% goes to our schools and community colleges, fire districts, cities, service districts, and other areas. Our overall budget is $2.0 billion, which includes the budgets of voter-created service districts, pass-through dollars from the state and federal governments to provide services, and development and other service fees.

The county’s general fund, which is overwhelmingly made up of property taxes the county receives for general operations, is budgeted at approximately $157.5 million for the 2024-25 fiscal year. These are discretionary funds that the Board of County Commissioners can allocate wherever it chooses. Of this $157.5 million, approximately $102 million (65%) is directed to public safety efforts (Clackamas County Sheriff’s Office, District Attorney’s Office, Juvenile Department). The Board of County Commissioners has made clear that public safety is a priority for our community.

How is the Budget Developed?

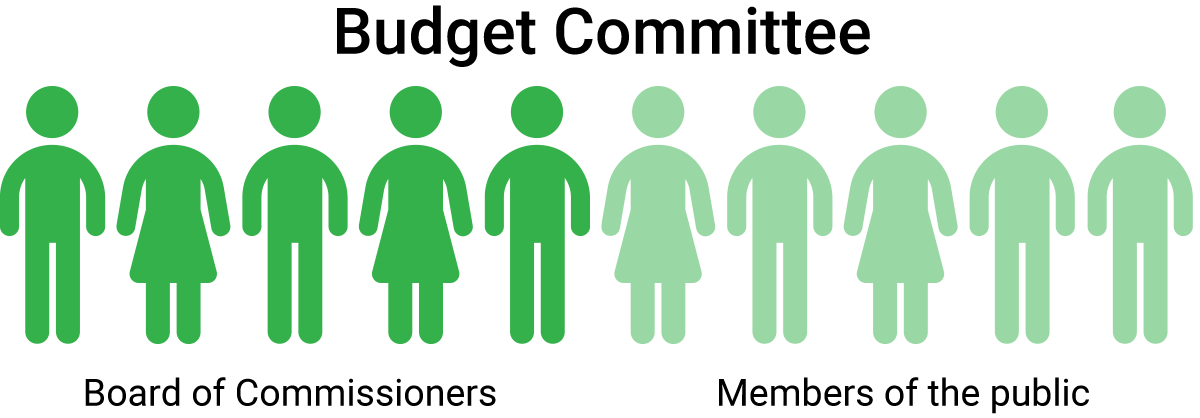

Throughout the year, the #ClackCo Budget Committee – made up of the five Clackamas County commissioners and five members of the public – meets to discuss the budget. Annually in late May, the committee holds its annual budget hearings. At these hearing this body — along with the budget committees of the service districts that #ClackCo oversees — pass approved budgets, which the Board of County Commissioners can adopt in a matter of weeks (before June 30). In accordance with state law, #ClackCo’s budget must be, and always is, balanced.

Translate

Translate